Economy

Inflation Will Continue Unless Major Changes are Done in Energy and The Food Sector

First American News – Raleigh, NC Factors affecting cars, rent, energy, and other categories play roles in determining if a drop will occur

To figure out where inflation is headed, don’t look at the overall economy, look under the hood

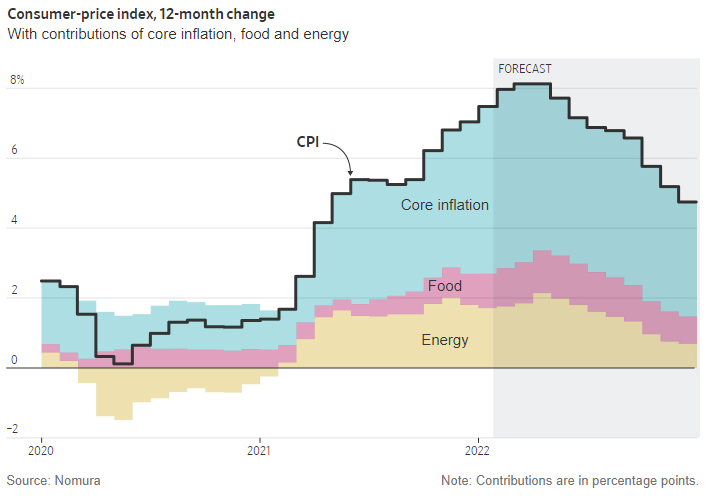

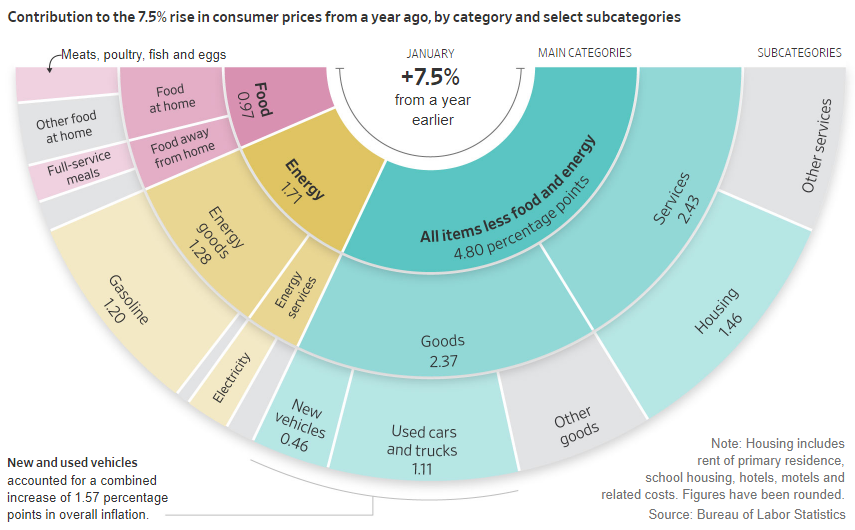

Inflation surged from 2.5% in January 2021 to 7.5% in January 2022 and could edge even higher as the impact of Russia’s invasion of Ukraine is felt on oil prices. But economists expect inflation to fall to between 2.7% and the upper-4% range by December.

How does inflation swing from 7.5% to around half that in just 11 months?

Normally, the main driver of inflation is the economy itself: the degree of economic slack, and the overall balance of supply and demand.

There are always outliers because of temporary events, such as an interruption to oil supplies. But these usually resolve on their own and don’t tell you much about where inflation will be in a year. So economists seldom try to predict price movements for discrete goods and services.

Now, though, the Covid-19 pandemic has disrupted so many industries that disaggregating inflation into its microcomponents is necessary as far as a year out, said Alan Detmeister, the economist at UBS.

“I’m a macroeconomist by training that believes, yeah, maybe for a month or two, you do disaggregate,” he said. “But right now is a special time—you have so many of these special stories hitting.” Standard models that predict inflation based on unemployment and economic slack would at best explain inflation of as much as 3.5%, he said. Those models missed the inflation surge and for the same reasons, are likely to miss the reversal, said Mr. Detmeister, who expects inflation to fall to 2.7% in December 2022.

Here is a look at what prices might come down—and what might go up—as 2022 unfolds:

Autos

It is hard to overstate how much of last year’s inflation drama boiled down to autos, and how much an improvement depends on car production.

It isn’t that autos make up a huge share of spending: New and used vehicles are about 7% of the average consumer’s spending basket currently. Rather, it is the sheer magnitude of the price changes that make them pivotal to the inflation outlook. The average new vehicle went for $46,404 in January 2022, up more than $5,100 from a year earlier, according to Cox Automotive.

Prices for used cars and trucks leapt 40.5% in January from a year earlier, contributing 1.1 percentage points of overall inflation. New-car prices shot up 12.2%, pitching in a further 0.5 percentage point. The combined contribution was five times as high as in January 2021.

A few things have to happen to idle this engine of inflationary pressure.

One is what economists call “base effects.” Prices in absolute terms might be high, but their contribution to inflation depends on the change from 12 months earlier. If auto prices simply stayed the same as in January, their contribution was five times as high as in January 2021.

A few things have to happen to idle this engine of inflationary pressure.

As for why prices are so high, the main reason is supply: A shortage of semiconductors has restrained auto production. Chip deliveries were taking 25.7 weeks in January, down slightly from December but nearly twice the typical pre-pandemic wait, according to Susquehanna Financial Group.

Semiconductor manufacturing will continue to catch up, such that auto output starts putting downward pressure on prices in the second half of 2022. However, Aichi Amemiya, senior U.S. economist at Nomura, said Ukraine-related fallout—for example, Russia is a significant exporter of palladium used in catalytic converters—will likely keep new-vehicle prices rising for much of the year, feeding through to higher used-auto prices too. Still, he expects new-car prices to rise just 3.1% in December, and prices for used vehicles to decline 1.8% that month.

Changes in demand will help too, said Omair Sharif, founder of Inflation Insights LLC. In normal times, rental companies are a sure source of used cars. But after shrinking their fleets when the pandemic hit, they then tried to rebuild, competing for used cars with consumers armed with stimulus checks and pent-up savings. Rental companies have now mostly rebuilt their fleets, with Avis Budget Group Inc. back to its 2019 fleet size, said Mr. Sharif, who expects price declines of 0.9% for new vehicles and 4% for used ones in December.

Laura Rosner-Warburton, the senior economist at MacroPolicy Perspectives, forecasts even bigger drops: 1.5% and 5% for new and used vehicles, respectively.

“There will be some consumer price sensitivity going forward because these very large, one-time cash stimulus payments that occurred in 2021 aren’t going to be repeated,” she said.

Aided by base effects, that will reduce the contribution to inflation from autos by between 1.5 and 1.8 percentage points in December from current levels, according to forecasts by Mr. Amemiya, Mr. Sharif and Ms. Rosner-Warburton.

Furniture

Dysfunctional supply chains and high demand inflated prices of other goods, too. Home furnishings and supplies rose 9.3% in January, adding 0.4 percentage points to inflation.

Mr. Amemiya bases his forecasts for household furniture, bedding, and appliances on input costs for manufacturers and supplier delivery-time indexes from the Institute of Supply Management and IHS Markit, which reflect how quickly suppliers are fulfilling orders. The latter tend to lead household furniture and bedding prices by a few months, he said. They have come down, but further improvement will likely be stalled by Ukraine-related disruptions. Mr. Amemiya expects furniture and bedding prices to rise 10% in December 2022, down from 17% in January. Appliances will decelerate to 7.8%, he forecasts, compared with their 8.5% increase last month.

Ms. Rosner-Warburton expects a 2.7% price increase in December, leaving home furnishings and supplies contributing 0.1 percentage point to inflation.

Rent

While economists expect inflation to ease, they don’t expect it to fall to the 1.8% rate reached in 2019. Rent is a big reason why.

Housing is crucial for the inflation outlook because it makes up nearly one-third of the consumer-price index. Even small gains can push up inflation a lot.

The way the Labor Department measures housing costs isn’t intuitive. It draws price data from new and existing leases, which feed into indexes for tenants’ rent and so-called owners’ equivalent rent that make up 8% and 24%, respectively, of the CPI. The latter doesn’t take home prices into account because the Labor Department deems home purchases to be a long-term investment, not a consumption good. Rather, it estimates OER based on what an owner would have to pay to rent her own home, based on rents for houses or apartments in high-homeownership areas.

The pandemic at first kept rents in check, because of the hit to the economy and the decision by many younger adults to move in with family. Rents have since rebounded because of falling unemployment and a return to more-normal living arrangements, with 1.4 million new households formed in 2021, according to census data.

In January, OER increased 4.1%, the fastest since March 2007. Tenants’ rent rose 3.8%. Combined, that contributed about 1.3 percentage points to inflation, double a year earlier.

Both indexes move slowly, because leases are typically renegotiated annually. But private-sector companies such as Zillow Group Inc. and ApartmentList show a sharp uptick in rents recently, hinting at more inflation to come, buoyed by a strong labor market and the lowest rental vacancy rate since the mid-1980s.

Mr. Sharif expects rent and OER to hit 5.1% and 4.9%, respectively, in December, contributing a combined 0.3 percentage point more to inflation than it does now.

Energy

Energy prices surged 27% in January from a year earlier, translating to 1.7 percentage points of inflation. That marked a big reversal from January 2021, when their fall subtracted 0.2 percentage points from inflation.

Gasoline, which comprises about half of energy consumption, surged 40% in January, generating 1.2 percentage points of inflation, with most of the rest coming from electricity and natural gas for home heating.

The interruption to oil supplies caused by the Ukraine conflict will likely be offset by increased U.S. production, Mr. Amemiya said. Based in part on the futures markets that indicate crude-oil prices will flatten out then move down toward the end of the year, he expects energy prices to rise 9.4% in December from a year earlier and their contribution to inflation to shrink to 0.7 percentage point.

Top Digital News Subscriptions