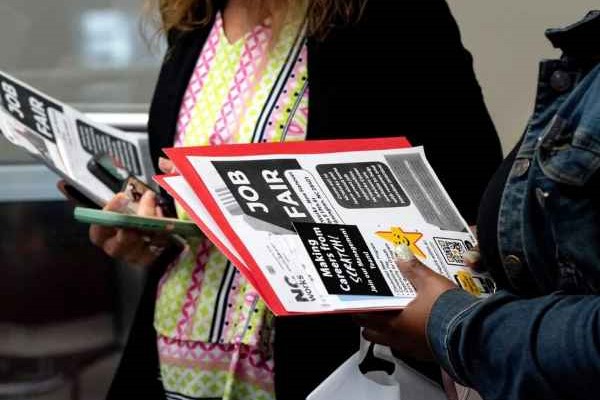

In April, the United States labor market exhibited resilience, as robust job growth persisted despite ongoing moderation in wage pressures. The eagerly awaited monthly report from the Bureau of Labor Statistics was released on Friday. It revealed that employers added an estimated 240,000 jobs last month, surpassing economists’ expectations. This underscores the economy’s steady recovery from the pandemic-induced downturn.

Factors Driving Employment Growth

The data, derived from a Bloomberg survey, indicated that the labor market continued its upward trajectory, with job gains outpacing the average pace witnessed over the latter half of 2023, according to The Financial Times report. This upbeat projection, the most optimistic since October 2022, suggests that the economy remains on a solid footing. Factors such as increased immigration and robust demand across various sectors buoy it.

Goldman Sachs economist Spencer Hill highlighted the significant role of immigration. He noted that heightened levels had bolstered the labor supply by approximately 80,000 individuals per month last year. This was compared to the norm. The sustained positive impact, estimated at an average of 50,000 per month in 2024, has contributed to the buoyancy observed in employment growth. This is particularly evident in sectors such as construction and leisure.

Wage Dynamics and Economic Outlook

However, amidst the backdrop of strong job creation, wage growth exhibited signs of moderation. Average hourly earnings rose by a modest 0.3% in April, maintaining the year-over-year growth rate at 4%, the slowest pace since June 2021. While wage pressures have eased somewhat, recent increases in minimum wages in California have presented upward risks. According to projections by Bloomberg Economics, this could potentially contribute to a slightly higher-than-expected surge in average hourly earnings.

Monitoring Labor Market Indicators

Despite the robust employment gains and the moderation in wage growth, economists remain vigilant about broader labor market indicators. While the unemployment rate held steady at 3.8% in April and labor force participation remained unchanged at 62.7%. Concerns persist regarding the disparity in unemployment rates among demographic groups. Of particular note is the Black unemployment rate, which surged to 6.4% in March, matching its highest level in over two years. Black unemployment typically shows greater volatility, but analysts consider it a critical indicator of broader labor market trends, warranting close monitoring in the coming months.

Implications for Monetary Policy

The latest labor market report reinforces the Federal Reserve’s cautious approach to monetary policy. With policymakers closely monitoring inflationary pressures and economic indicators, including job growth and wage dynamics, the data from April provides further insights into the ongoing recovery. It also informs the central bank’s decision-making process regarding interest rates and other policy measures. As the economy continues to navigate through the post-pandemic landscape, the resilience of the labor market remains a key determinant of its overall health and trajectory.

Acquire a two-year subscription to The Wall Street Journal: Revel in daily delivery six days a week and access WSJ Digital. Stay thoroughly informed about finance, politics, healthcare, and global events with this comprehensive package. Delve into expert insights and reliable evaluations to broaden your perspective. To purchase a subscription, call WSJ Cell Phone: (800) 581-3716