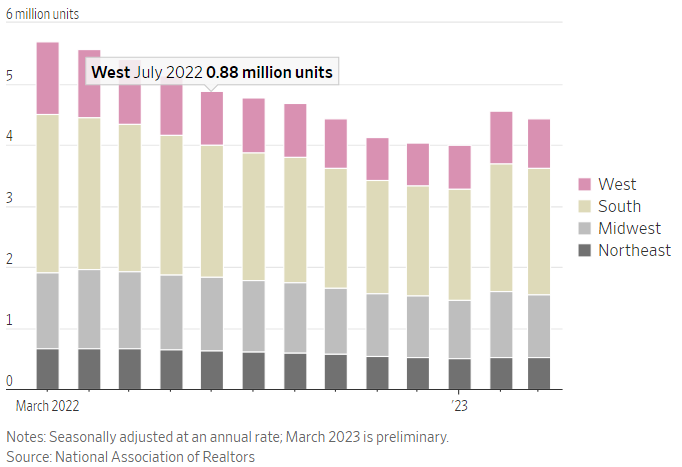

Home Sales – Sales of previously owned homes fell in March from the prior month as higher mortgage rates slowed buying activity.

US existing-home sales, which make up most of the housing market, fell 2.4% in March from the prior month to a seasonally adjusted annual rate of 4.44 million, the National Association of Realtors said Thursday. March sales fell 22% from a year earlier.

The US housing market has slowed dramatically in the past year as rising mortgage rates, high home prices and persistently low inventory frustrated buyers and pushed many of them out of the market.

A cooling economy, with stubbornly high inflation and many economists forecasting a recession in the next 12 months, keeps some buyers on the sidelines. Consumers also borrowed less following the collapse of Silicon Valley Bank and Signature Bank last month, a Federal Reserve report said Wednesday.

Great Investment Opportunity in Omoa Honduras – Front Beach Property

Mortgage rates have fluctuated recently since hitting 20-year highs above 7% in October and November. According to Freddie Mac, the average rate for a 30-year fixed mortgage was 6.27% in the week ended April 13, up from 5% a year earlier. The Federal Reserve has raised its benchmark federal funds rate nine times since the start of 2022 to tame inflation.

The slowdown in home sales weighs on prices, especially in the western half of the US. NAR said that the national median existing-home price fell 0.9% in March from a year earlier to $375,700, the biggest year-over-year price decline since January 2012. Median prices, which aren’t seasonally adjusted, were down 9.2% from a record $413,800 in June.

US median existing-home price, change from a year earlier

“The consumer appears to be very sensitive to changes in week-to-week mortgage rates,” said Lawrence Yun, NAR’s chief economist. “It almost appears that people are just waiting for the right rate before deciding or closing.”

Economists surveyed by The Wall Street Journal ahead of the release had estimated that sales of previously owned homes fell 2% in March from the prior month.

The labor market has cooled some but remains solid. More workers have filed for unemployment benefits this year, likely reflecting layoffs in technology, finance and real estate.

Worker filings for initial jobless claims, a proxy for layoffs, increased by 5,000 to a seasonally adjusted 245,000 last week, the Labor Department said Thursday in a separate report. Last week’s reading was just below the highest level in 2023 and above the 2019 average of about 220,000.

Get 52 weeks of The Wall Street Journal Newspaper daily delivery to your home or office.

The housing market is usually the most active in the spring because families with children often want to move homes between school years.

This spring’s activity is muted compared with the housing boom that extended from mid-2020 through early 2022 when low mortgage rates and a desire for more space during the pandemic led to a surge in home sales.

Most people who bought homes in recent years don’t yet need to move again, and many homeowners are reluctant to give up their low mortgage rates, said Daryl Fairweather, chief economist at real-estate brokerage Redfin Corp.

Get 2 Years of The Wall Street Journal Print Subscription with daily delivery 6 days a week

“That demand has already run its course, and now we’re left with leftovers or people who missed the boat,” she said.

US existing-home sales in March, by price range, change from a year earlier

Home prices are declining the most in the West. Median home prices fell the most in March compared with a year earlier in Boise, Idaho; Austin, Texas; and Sacramento, Calif., according to Redfin.

But in other parts of the country, prices are rising from a year earlier because the inventory of homes for sale is unusually low for this time of year.

NAR said there were 980,000 homes for sale or under contract at the end of March, up 1% from February and up 5.4% from March 2022. At the current sales pace, there was a 2.6-month supply of homes on the market at the end of March.

The number of homes for sale is up from a year ago because houses sit on the market longer. But the number of new listings in March fell 20% from a year earlier, according to Realtor.com.

Inventory typically rises in the spring as sellers want to take advantage of the busiest buying season.

Take the best of market news today by signing up to Bloomberg digital, and receive 70% Off.

“The question is, who’s going to win? Are the buyers going to chew up all the inventory there, and we’ll still be waiting for more homes to come on?” said Bill Boswell, a real estate agent in Wayne, N.J. “Or will enough homes come on to satisfy the demand?”

Homes typically go under contract a month or two before the contract closes, so the March sales data largely reflect purchase decisions made in February and January.

The share of first-time buyers in the market was 28% in March, down from 30% a year earlier. About 27% of March existing-home sales were purchased in cash, down from 28% in the same month a year ago, NAR said.

Charlie Rasmason and Ben Westphal looked at houses in the Chicago suburbs in early 2022. Still, they decided to keep renting because the available homes within their budget needed much work. More inventory was available when they tried house hunting again in early 2023, but mortgage rates had risen, increasing their expected monthly payments.

In March, they bought a three-bedroom house in Westchester, Ill., for $369,000, about $10,000 below the listing price. “It was the right call despite the interest [rate] being what it is,” Mr Rasmason said. “It went as well as it could have.”

US existing-home sales by region

Existing-home sales fell the most month-over-month in the Midwest, down 5.5%, and in the West, down 3.5%.

NAR said that the typical home sold in March was on the market for 29 days, up from 17 days a year earlier.

“I think we’ve hit kind of the bottom” regarding pricing, said Lauryn Dempsey, a real estate agent in the Denver area. “It’s not as competitive as it was at the same time last year, but we still have a really-low-inventory problem.”

Housing starts, a measure of US home building, fell 0.8% in March from February, the Commerce Department said. Residential permits, which can be a bellwether for future home construction, fell by 8.8%.