Economy

Stocks Fall As Recession Fears Grow

Stocks Fall – Stocks and bond yields fell Thursday, pressured by weak corporate earnings reports and economic data reinforcing investors’ recession fears.

Major indexes dropped at the opening bell, recovered much of their losses shortly after midday and tumbled again in afternoon trading, snapping a two-day lull when New York-listed shares barely budged.

The S&P 500 declined 0.6%. The Dow Jones Industrial Average shed 110 points or 0.3%, and the Nasdaq Composite fell 0.8%. All three indexes are poised for modest weekly drops.

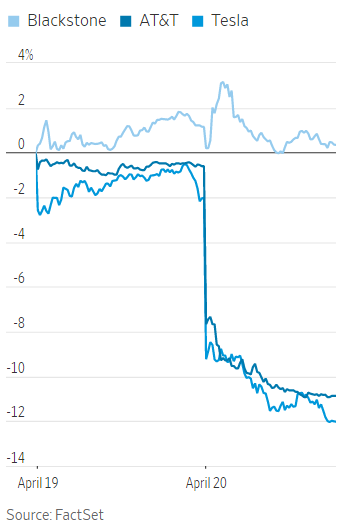

STOCK PERFORMANCE

Ten of the 11 sectors in the S&P 500 notched declines, led lower by the real estate and consumer-discretionary segments, which fell more than 1%. AT&T Stocks Fall 10% after the telecommunications company said that the slowing economy is denting business service demand. Tesla fell almost 10% after reporting late Wednesday a 24% first-quarter profit decline caused partly by price cuts.

All together, profits among companies in the S&P 500 are projected to fall 6.4% in the first quarter, compared with a 10% rise in last year’s first quarter.

That tepid trend has deepened concerns that the Federal Reserve’s effort to fight inflation by raising interest rates pushes the economy toward a recession.

“The tone of earnings reports has been pretty downbeat,” said Edward Park, chief investment officer at London-based Brooks Macdonald for The Economist E-Paper. “It’s not pushing back against the recession narrative, and equally, it’s not endorsing it.”

A smattering of new economic data Thursday suggested slowing growth. Initial jobless claims rose by 5,000 to 245,000, a sign of more slack in the job market. According to a survey of regional businesses by the Philadelphia Fed, manufacturing activity in April fell to the lowest level since May 2020.

Get 52 weeks of The Wall Street Journal Newspaper daily delivery for $318

Those figures pushed down government bond yields, which are strongly influenced by expectations of how the Fed will set interest rates. The benchmark 10-year yield fell to 3.546% from 3.601% Wednesday. Yields decline as bond prices rise.

Last month, turmoil in the banking sector broadly lowered traders’ projections for how high the Fed will raise interest rates. According to CME Group’s futures-market tracker, many are wagering another quarter-percentage-point rate increase in May will be the central bank’s last rate increase for now.

Yet investors hoping that the Fed will cut rates quickly later this year a potential boon for the stock marketmay be out of luck, said Amanda Agati, chief investment officer at PNC Asset Management. She noted that inflation remains a pressing concern, and it is too soon for the Fed to relax its stance.

“We’ve been saying for a while now that the market is like a kid in a candy store, craving a sugar high from more policy accommodation,” Ms Agati said for Bloomberg Digital Subscription.

Get 2 Years of The Wall Street Journal Print Subscription with daily delivery for $480

A continued flow of earnings from financial companies mostly disappointed investors, dragging down share prices. Private-equity giant Blackstone fell 0.7%, Truist Financial declined 3.8%, and KeyCorp, the parent company of KeyBank, fell about 2.8%.

A downturn in the financial sector could hurt a swath of industries if loans get harder to come by. “That’s how we fund growth in this economy,” said portfolio manager Colby Stilson of Brown Advisory.

Concerns about weakening demand hit oil prices. Brent-crude contracts, the global price benchmark, settled at their lowest level this month, falling 2.4% to $81.10 a barrel.

Futures for diesel fuel are trading at their lowest level in a year a bearish sign for the broader economy because diesel is used for trucks and heavy machinery, said Ole Hansen, head of the commodity strategy at Saxo Bank.