Markets

Tesla’s stock – Tesla Keeps Growing, but at What Cost?

Tesla’s stock is back to being boringly expensive. There was nothing in the electric-vehicle maker’s first-quarter volume data to move the needle on investors’ typically entrenched views. Tesla said on Sunday it produced just shy of 441,000 vehicles and shipped almost 423,000. The latter number was 4% more than the previous quarter and 36% more than in the same period last year.

Bulls can see that as another incremental step in the company’s growth. It marked a solid third consecutive quarter of expanding sales following the difficult second quarter of 2022, when it was hit by Covid-related lockdowns in China. Given the backdrop of rising interest rates, which is showing some early signs of hitting auto demand, and intense competition in China, where EV subsidies have shrunk and rivals such as BYD are eating into Tesla’s market share, it could have been a lot worse.

Get 52 weeks of The Wall Street Journal Newspaper daily delivery to your home or office.

Bears can point out that Tesla kept its growth on track only by massively cutting vehicle prices. The price in the U.S. of a long-range Model Y is $11,000 or 17% lower than at the start of the year, according to brokerage RBC. In China, the same vehicle is 21% cheaper than in September. Furthermore, production exceeded deliveries by 4%—about half the previous quarter’s mismatch, but still pointing to rising inventories. Tesla’s shares fell 3% at the open on Monday, but that followed a 6% rally on Friday.

Tesla in recent months has doubled down on its original mission of growing as fast as possible, never mind the cost in a deteriorating sales environment. A big question for investors now is what that cost will be. Analysts debate whether gross margins excluding regulatory credits, a key measure of profitability, will be below or above 20% when Tesla reports its quarterly earnings on April 19. For 2022, the number was roughly 27%.

However this turns out, it won’t be the last word on the company’s profitability, given how often it tweaks its prices. Tesla is also working on a lower-cost production platform that will change the economics of its business again once it eventually launches. The company’s margins will be a moving target for years, and for the next couple probably a declining one after the bonanza of high vehicle prices during the pandemic.

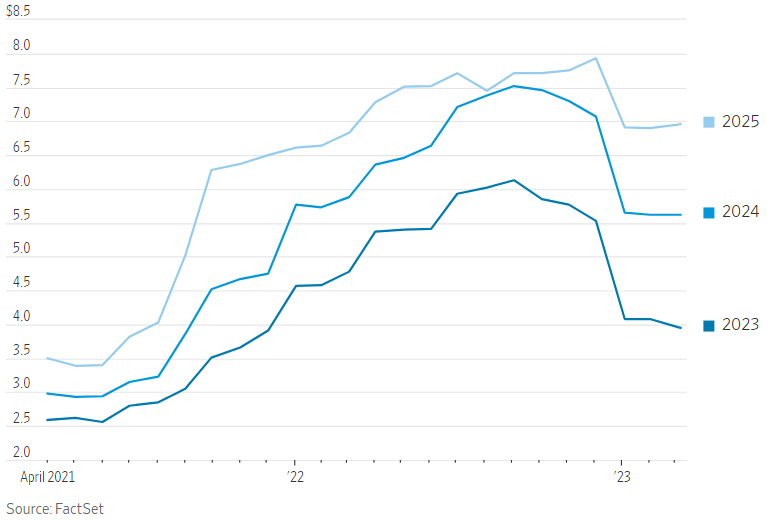

Consensus estimates for Tesla’s earnings-per-share

Lower margins this year will even offset the profit impact of continued growth in deliveries, according to The Wall Street Journal Subscription. The current consensus according to FactSet is for a slight fall in net income this year, the first decline since Tesla became profitable in 2019. The forecast cuts started last fall, but continued in the first quarter even as Tesla shares jumped 68%.

The result is that Tesla’s stock has become once again very expensive compared with its profit and its peers. The forward price-earnings ratio is now 47 times, up from about 20 at the start of the year. Its market value is $656 billion, well over three times that of Toyota, the world’s largest car maker by sales. Including the dilutive impact of stock options, which are a real cost to shareholders, the gap is even wider, with Tesla’s market value at $737 billion.

The only world in which this makes sense is one where the EV maker will take a lion’s share of industry profit, following the pattern of Apple and mobile phones. The competitive battles in China, the world’s most developed EV market, show that the road to this potential future, which was never wide, continues to narrow.